MORTGAGE MARKET NEWS │ 11.4.16

THREE CENTRAL BANK MEETINGS

Over the past week, the meeting of the Bank of England and news related to the U.S. election were the main influences on mortgage rates. The U.S. economic data had little impact. The net result was that mortgage rates ended the week a little lower.

Three major central banks had meetings over the past week, and none of them made any policy changes. In the case of the U.S. Fed and the Bank of Japan, this was the expected outcome. However, investors were disappointed that the Bank of England (BOE) held rates steady and downplayed the likelihood of further rate cuts. Bond purchases from central banks around the world have helped push global bond yields lower in recent years, so this indication from the BOE that there may be less future stimulus than expected caused yields to rise on Thursday, including U.S. mortgage rates.

As expected, the Fed made no change in policy and few changes in its statement. The statement suggested that the economy is closer to the threshold required to increase the federal funds rate. Fed officials also expressed more confidence that inflation will rise to its target level of 2.0% "over the medium term."

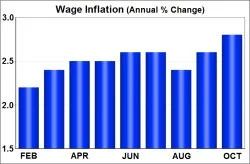

The economy added 161K jobs in October, a little below the consensus of 175K. However, upward revisions added 44K jobs to the results for prior months. Investors focused more on wage growth, which rose more than expected. Average hourly earnings were 2.8% higher than a year ago, which was the largest annual increase since June 2009.

Over the past week, there were many news stories about the two candidates in the U.S. election, and some of these stories had a noticeable effect on mortgage rates. Generally, news which favors a Trump victory has been positive for bonds and negative for stocks. News which favors a Clinton victory has caused the opposite reaction.

Looking ahead, the U.S. election likely will continue to influence mortgage rates. In addition, there will be Treasury auctions on Tuesday, Wednesday, and Thursday. The economic calendar will be very light. The JOLTS report, which measures job openings and labor turnover rates, will be released on Tuesday. Consumer Sentiment will come out on Friday. While the stock market will be open, mortgage markets will be closed on Friday in observance of Veterans Day.